1xBet Cinta uses AML (Anti-Money Laundering) and KYC (Know Your Customer) to make sure that all transactions on the platform are safe and legal. These rules assist stop financial crimes by checking who users are and keeping an eye on their actions for anything that seems off.

Some important parts of AML and KYC at 1xBet Cinta are:

- Verification of identity using official papers

- Watching transactions all the time

- Risk assessment to find trends that are out of the ordinary

- Following the rules set by regulators

This method protects users and keeps 1xBet’s online gaming environment safe.

Transaction Monitoring Standards

1xBet Cinta’s AML framework includes transaction monitoring, which is a very important aspect of it. It is meant to find and reduce the dangers that come with unlawful activity. This procedure includes constantly looking at user transactions to make sure they follow the rules and keep both the platform and its users safe.

1xBet Cinta keeps a close eye on things by:

- Tracking deposits, withdrawals, and betting trends in real time

- Marking transactions that are strange or risky for more scrutiny

- Automated technology and manual checks work together to find fraud or money laundering.

- As needed, telling the right people about strange behaviour

These rules for monitoring transactions keep the platform’s promise of safe and responsible gambling and keep things clear.

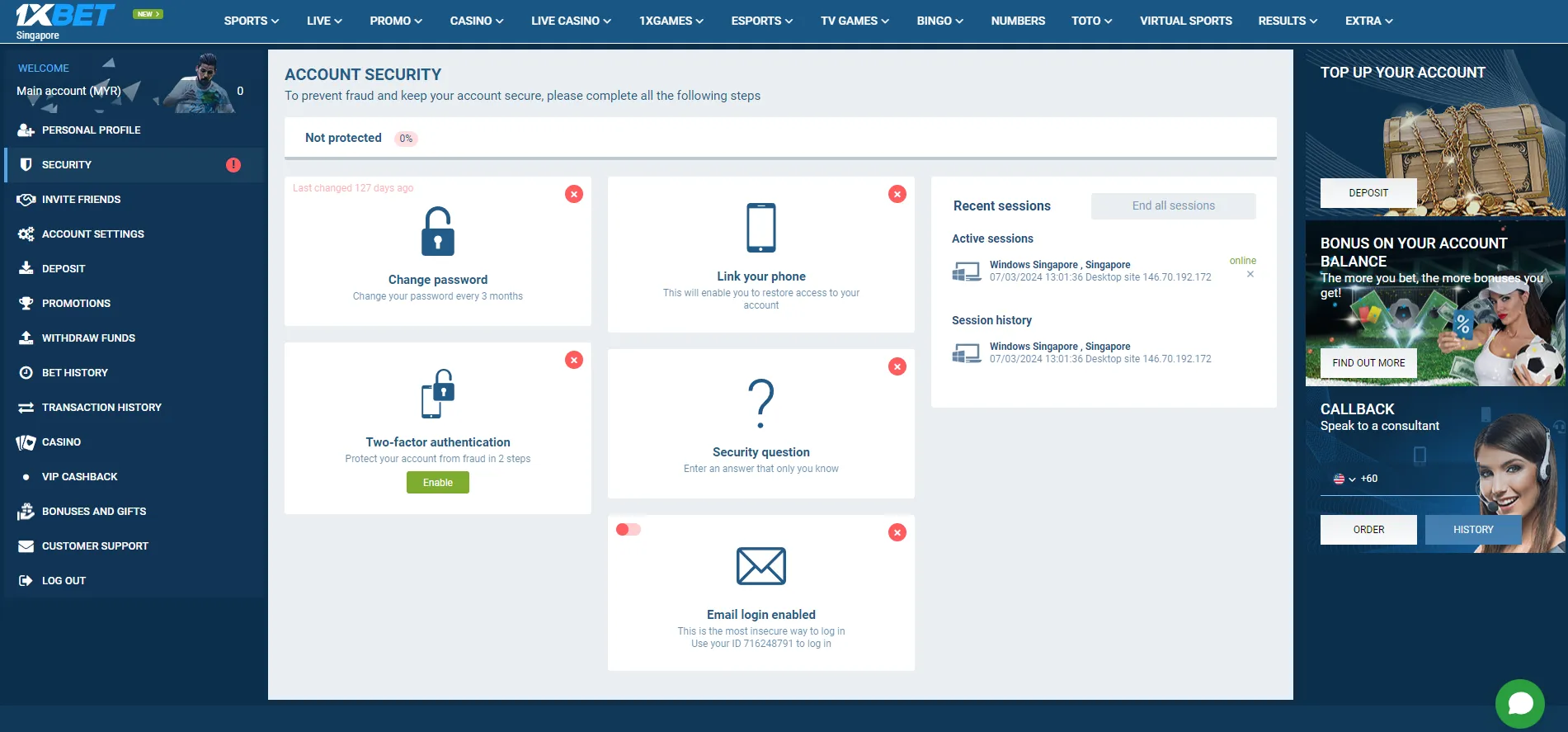

Customer Verification Procedures

1xBet Cinta is committed to following AML and KYC rules, and one of the most important parts of that is checking customers’ identities. These steps make sure that everyone who wants to utilise the platform’s betting and casino services is correctly recognised.

The process of checking out a consumer includes:

- Identity Documentation: Users must provide a government-issued ID, such a passport, driver’s license, or national ID card.

- Address Verification: To prove where you live, you usually need to show utility bills or bank records from a certain period.

- Age Confirmation: Verification makes sure that all consumers are old enough to gamble legally.

- When to Verify: When you sign up for an account or make your first withdrawal, you go through an initial verification. If there is any unexpected behaviour, more checks are done.

These steps help keep the platform and its users safe, lower the chance of fraud, and make sure that the rules are followed.

Risk-Based Customer Assessment

1xBet Cinta’s AML and KYC methodology includes a very important part: checking consumer risk. This technique lets the platform change how it checks and monitors users based on how risky they could be.

Some important parts of the risk-based evaluation are:

- Evaluating the Customer Profile: Looking into things like where the account is located, how often transactions happen, and what the account is doing.

- Risk Categorisation: Customers are put into groups based on how much due diligence is needed for them: low, medium, or high risk.

- Enhanced Due Diligence (EDD): This is for users who are at a higher risk and includes more thorough checks and continual monitoring.

- Continuous Monitoring: Checking accounts regularly to look for strange activity or changes in risk status.

1xBet Cinta improves resource allocation and makes sure that rules are followed by using this method.

Ongoing Transaction Analysis

To find problems and make sure that AML rules are being followed, financial activity must be watched all the time. This continual examination of transactions helps find patterns that could show someone is acting suspiciously.

Key aspects include:

- Automated Monitoring Systems: Using complex algorithms to find strange behaviour as it happens.

- Pattern Recognition: Keeping an eye on behaviour based on recognised risk factors, including making big or frequent payments.

- Creating notifications: When strange things happen, alarms are sent out for more examination.

- Regular Reviews: Regularly checking accounts to make sure they are following the rules and changing their risk profiles.

This methodical approach makes it easier to quickly deal with possible risks and keep the platform’s operations running smoothly.

Sanctions and PEP Screening

Effective compliance systems include rigorous screening methods to find people and organisations who are subject to regulatory constraints. This involves keeping an eye on politically exposed people (PEPs) and those who are on different watchlists.

Key components involve:

- Comprehensive Databases: Using up-to-date global lists to check clients against those who are not allowed to do business with them.

- Identifying PEPs: Finding people in important public jobs who could be more likely to be a threat.

- Automated Screening Tools: Making sure that matches are found quickly during onboarding and continued monitoring.

- Ways to reduce risk: Using more thorough due diligence when possible matches are identified to avoid breaking the law.

By reducing the risk of illegal behaviours, this framework helps keep the operational environment safe and compliant.